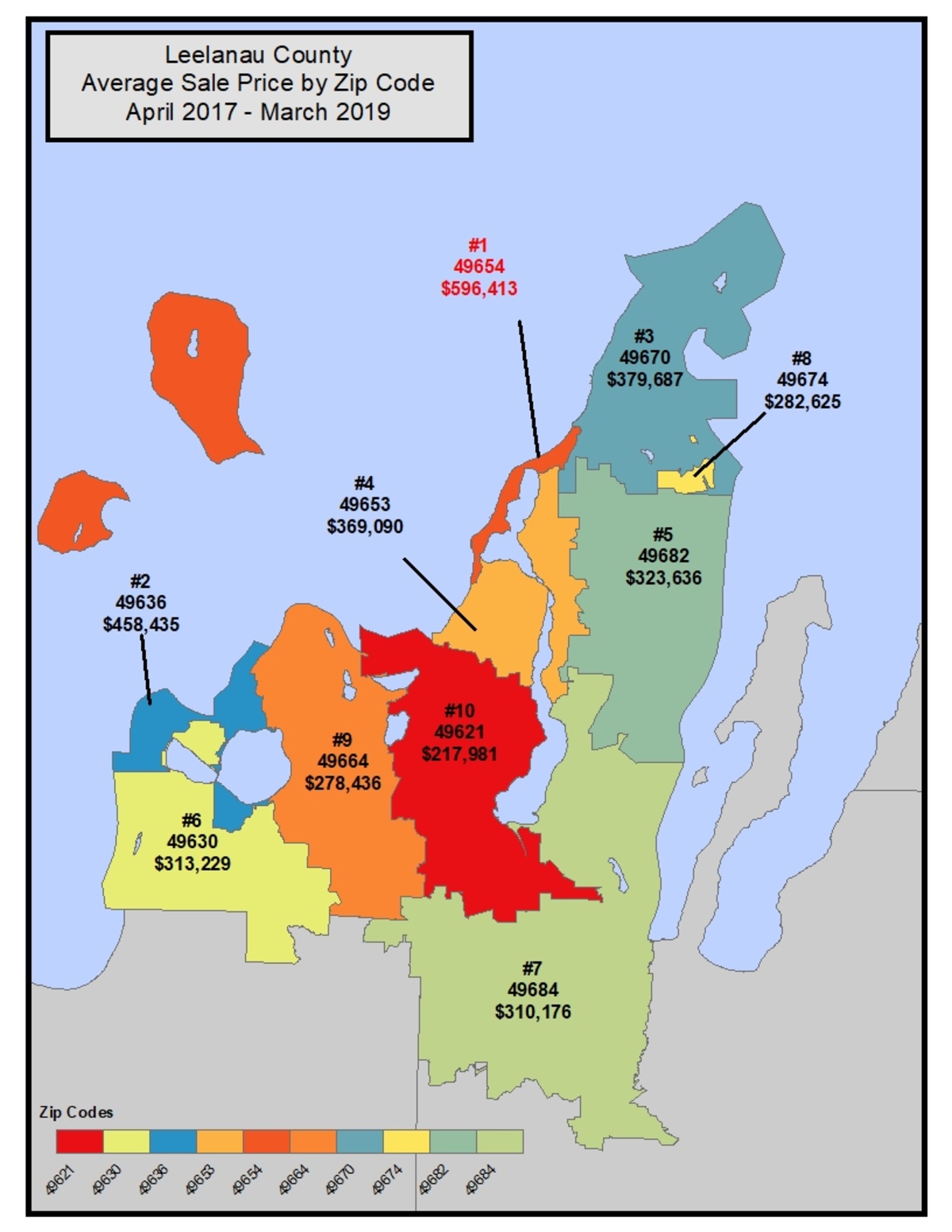

Here’s The Average Selling Price Of Leelanau Properties By Zip Code

March 5, 2020

It’s property assessment time, and Leelanau County Equalization Director Laurie Spencer is working with township assessors assure proper equalized values for real and personal property throughout the county. By the second Monday in April, Spencer will prepare a report that recommends the equalized value of each class of real and personal property for each local unit and present it to the County Board of Commissioners.

Under statues and guidelines established by the State Tax Commission, Spencer performs studies of sales and appraisals by class within each township, to provide a fair system of property assessment and taxation.

“To help the Board of Commissioners equalize property tax assessments; we go out to the townships and take a sampling of parcels and set the assessed value at 50% of true cash value of the property,” Spencer says. “My study is a projection of value based on a sampling from each township.”

Here are some key stats Spencer shared as part of Leelanau County’s most recent equalization study.

Residential Class is 89.11 percent of Total County Assessed Value

Commercial Class is 4.76 percent of Total County Assessed Value

Agricultural Class is 4.36 percent of Total County Assessed Value

Personal Property Class is 1.48 percent of Total County Assessed Value

Industrial Class is .29 percent of Total County Assessed Value

From April 2017 to March 2019, there were 34 residential sales over $1 million in Leelanau County.

These are the average property sale prices by Leelanau zip code from April 2017 to March 2019:

#1 49654 $596,413

#2 49636 $458,435

#3 49670 $379,687

#4 49653 $369,090

#5 49682 $323,636

#6 49630 $313,229

#7 49684 $310,176

#8 49674 $282,625

#9 49664 $278,436

#10 49621 $217,981

Among Michigan’s 83 counties, Leelanau County had the highest average taxable value for residential properties in 2018, and Lake County had the lowest. Residential parcels in Leelanau had an average taxable value of $122,270 in 2018. Also in the top five: Washtenaw ($106,007), Oakland ($98,524), Livingston ($97,367) and Emmet ($96,522).

CommentThe Latest Leelanau County Blotter & 911 Call Report

The Leelanau Ticker is back with a look at the most alarming, offbeat, or otherwise newsworthy calls …

Read More >>Top 8: Comeback Stories Were The Recurring Theme In Leelanau's Biggest News Of 2025

Don’t call it a comeback…except, maybe do! Returns and resurrections seemed to be the prevailing theme in …

Read More >>Property Watch: Bright and Cozy in Maple City

This brand new listing offers a smallish but updated home near Maple City.

"This well-kept 3-bedroom, 2-bath …

Read More >>Amazon Deliveries Provide Small Business Boost in Leelanau County

An online retailing behemoth that’s often criticized for putting the squeeze on small businesses is now providing …

Read More >>